Table of Content

Using these defence mechanisms may also be a requirement for some insurers. Thatched houses are built in a specialist way using unique skills and materials so the insurance can often be more expensive. Heritage Insurance Agency has been specialising in the insurance of thatched properties for many years.

The higher this figure is the more likely it's that you will have to pay higher premiums on your thatched house insurance, so you will want to do whatever it takes to avoid any fire in your home. However, reducing the chance of a fire and showing you take your property’s protection very seriously, will help your chances with getting a better deal with the insurer. With thatched house insurance, insurance companies will usually be able to give you a better deal, and generally will be able to tailor a plan to suit you. This means you could get a cheaper deal on your buildings insurance premiums. We insure mid-terrace thatch properties and listed homes with unusual construction such as cob walls. After that, we insure thatched holiday homes, thatched second homes and thatch let properties.

Business Indemnity Insurance

Whether you’re early in your career or a more experienced insurance professional, Aston Lark offers a great opportunity to develop your career. Whether is it a single electric supercar insurance policy you are looking for or a personal collection of supercars under one policy, we can help. Finding the optimum balance between cover and price for your Jaguar can be difficult. We have the ability and knowledge to find a Jaguar Insurance policy that suits you. As one of the most luxury car manufacturers, we have a knowledgeable team to offer advice and guidance to find you the right Bentley Insurance cover.

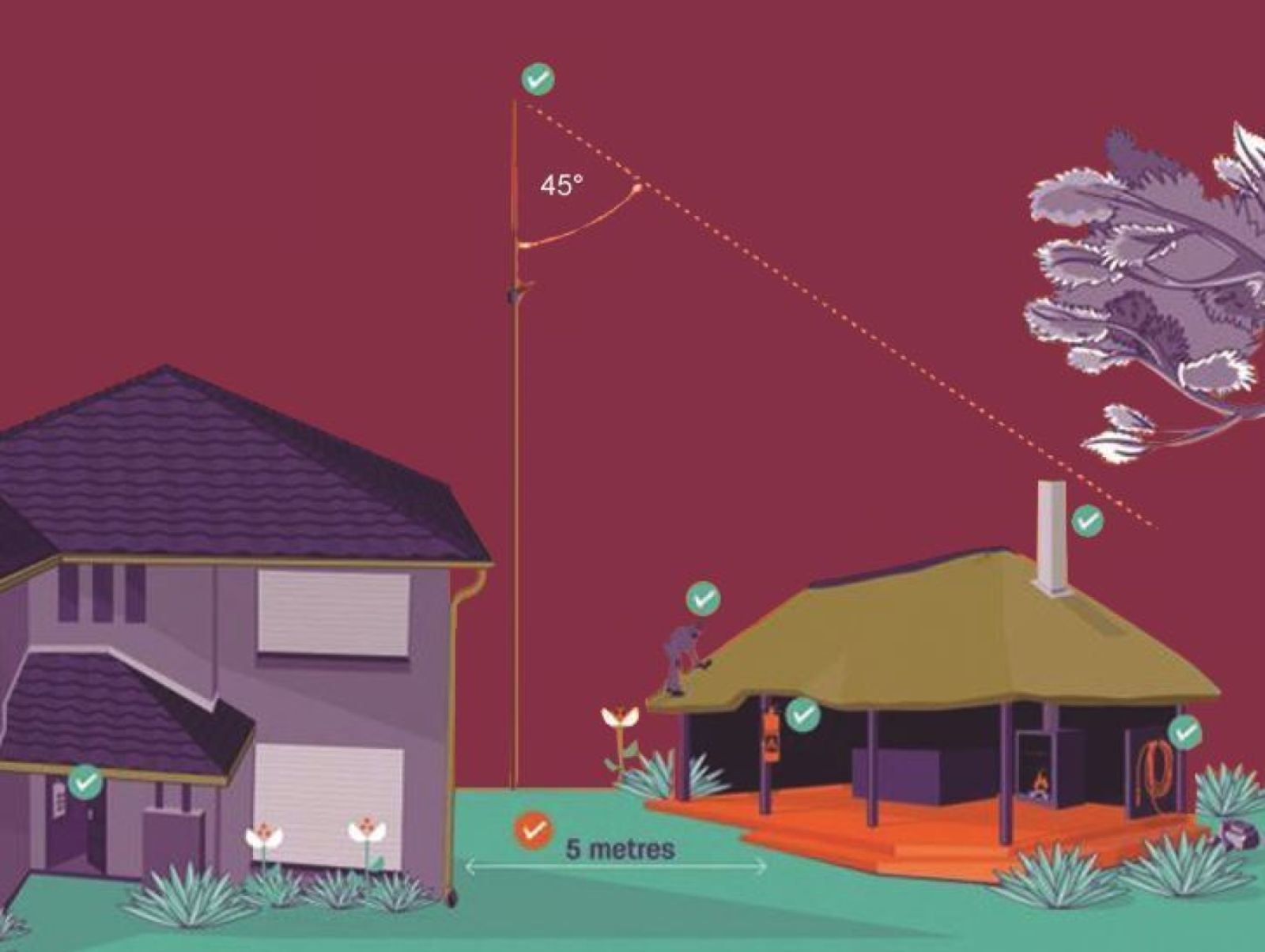

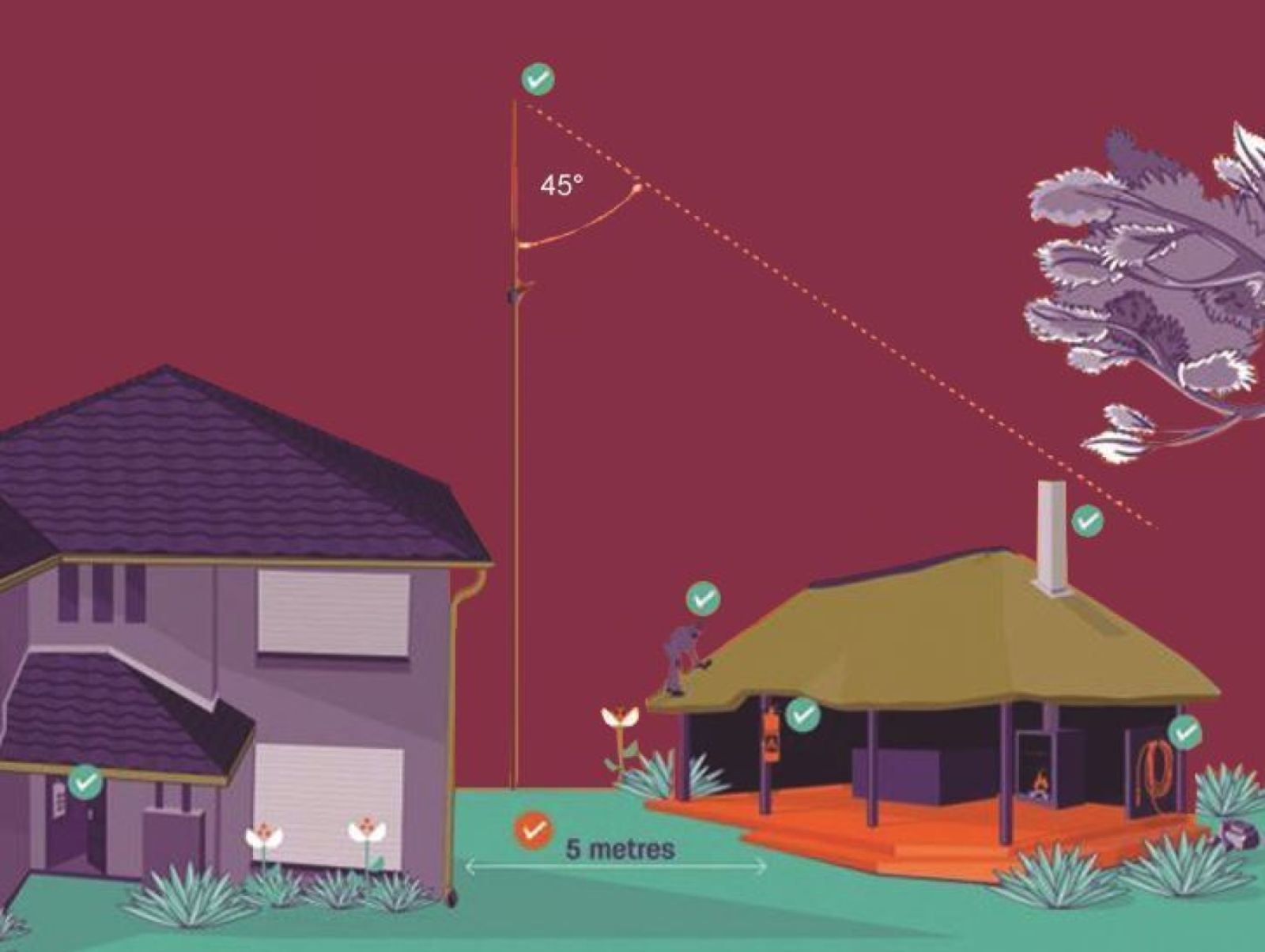

Thatched property insurance is a form of non standard house insurance and falls into the same category as for example a listed building or a building located in a flood risk region of the UK. Although a fire is no more likely to start in a thatched house than a regular house, the materials used in thatched roofs can cause a fire to spread more quickly and cause more damage. This means the risk is far greater and repair costs will be much higher. Due to the age of many thatched roofs, their potential maintenance costs, and the links to fire risks, some insurance companies charge a higher premium to cover them. They may also charge an expensive excess fee for home repairs, including the roof, of which maintenance work is inevitable on thatched homes. Read on to find out more about thatched house insurance, and how you can minimise damage to your thatched roof, and make sure you have appropriate insurance for thatched cottages.

Tom Chapman, Head of Sales, The Home Insurer

Our fleet auditing service provides you with a clear and detailed report which identifies the strengths and weaknesses in your overall Occupational Road Risk programme. Our risk control survey menu offers three different and innovative ways to carry out a survey, no matter when and where. We have specialist knowledge of the metal recycling and vehicle dismantling industries which stretches to over 20 years. Commercial Motor Fleet insurance is vital for many organisations, as their fleet of vehicles is a significant investment and is often a key part to ensuring their operations are efficient and successful. We arrange cover for motor traders, haulage operators, self-drive hire companies, vehicle recovery operators and classic car restorers, as well as a whole fleet of others.

Therefore, avoiding having to make any claims in the future, which is likely to result in higher premiums on your insurance policy for the following year. It’s hard to give an average cost for a thatched roof property insurance policy, as the premium will be dependent on other factors than just the roof. However, you might want to get specialist insurance from a non-standard home insurance provide anyway. As mentioned previously, a non-standard home insurance provider will have a better understanding and more experience when it comes to insuring properties with thatched roofs.

Listed Property Insurance

We are able to provide flexible cover to cater for the unique challenges that can come from such a wide variety of different organisations. Through many years’ involvement in the education sector, we understand the unique insurance needs of our clients, the pressure on budgets and the need to deliver real value for every penny spent.

Electric cars are the future, so don’t get stuck in the past when finding the right insurer. At Aston Lark, we understand how valuable your classic car is and we share that passion. We pride ourselves in being customer focused and will always strive to find you the cover you need. If your home has a history of movement or is known to have subsidence then you need subsidence insurance. Finding insurance for a home that’s unusual, unique or quirky can be difficult.

Marine Cargo Insurance

That is a simple fact that comes down to a few key factors that make thatch roof houses more likely to incur a loss or for that loss to cost a bit more. Some but not all factors at play are the flammable materials, expensive labour costs and the requirement of extensive maintenance. You can get a thatched roof insured, even today, although it's not as easy to get a thatched roof insured than it is a standard roof. This is due to the lack of modern knowledge and shift in preferences that has left the underwriting of thatch to be a niche only exercised by a few specialist insurers. These insurers, although not common, are not too hard to find; you may have to look online as opposed to using your local insurance provider or broker.

At Aston Lark, our personal insurance team is entirely focused on people whose properties, possessions and assets fall outside the ordinary. To support your journey to workplace wellbeing each quarter, we will provide you and your employees with a Journey To Wellness roadmap. A relevant life plan helps make sure their dependents will be looked after in the event of their death, helping your team run your business with peace of mind. Help your employees understand their benefits with Aston Lark’s group sessions and one-to-ones. At Aston Lark, we will search the market to find a fitting provider and relieve you of the administrative burdens of running your employee benefits scheme.

It’s always best to research and shop around to compare home insurance quotes and find a policy that suits your needs and is affordable. If you own a thatched property and are looking for a great deal on your buildings and contents insurance with a specialist in thatched properties, then look no further. Whether it’s for your home, holiday hideaway or buy-to-let nest egg, we provide specialist thatched property insurance that won’t let you down. A thatched house might be your dream home, but for thatched housing cheap building insurance can be hard to come by. Read our guide to find out more about thatched home insurance and how to insure your home when your property is made with non-standard materials.

Finding the right insurance policy for your high value supercar can be challenging. Aston Lark the ability and knowledge to find a supercar insurance policy that suits you. A standard home contents policy is unlikely to be suitable as it will contain sub-limits and exclusions. If your home is non-standard and you’ve not told your insurer, you run the risk of a claim not being paid or even your policy being cancelled.

From experience, we know that generic insurance products don’t always fulfil the needs of the most affluent and high net worth clients. And this is especially true for those in need of cover for multiple high-value or prestigious vehicles. People are often unaware of the true value of their watch and that, in the event of a loss, their home insurance may not fully cover the cost to replace it. Either way it’s very important to protect your collection, Speak to Aston Lark about specialist wine insurance. Whether you have a large art collection or just a few pieces, you should check it has the correct insurance cover. We provide you with high quality advice and guidance gleaned from more than 60 years of operating in this field.

It's worth seeking advice from professional thatchers, property experts and other thatched roof owners to suss out the best kind of home insurance for you. Unlike concrete roofs, thatched roofs are made from completely natural materials, and created by traditional methods passed down throughout the centuries. Thatching is made from thick layers of dry long wheat straw, reeds, heather, or other types of vegetation, in a shape that is unique to that structure. You can Contact Thatchline Insurance to discuss home insurance for your thatched property, no obligation whatsoever.

If you have a home with a thatched roof, you might find it harder to get cheap buildings insurance premiums. That’s because insurers are weighing up the risk of protecting your property. Thatched roofs are generally harder to maintain and come with a greater risk of fire damage than regular roofs. On top of that, thatched roofs often require work carried out by specialists, which might be more expensive than your usual maintenance work. If you have a newer thatched property (i.e. one that was built in the last 50 years or so) then you may find the materials used are of a higher quality than if you have one from the 18th century. If that's the case you might find a regularbuildings insurance providerwilling to insure your property.

They are made from natural, sustainable materials that are often locally sourced, and also provide excellent insulation, allowing homes to retain heat in winter and stay cool in summer. Skilled thatchers maintain some of the UK’s oldest cottages and homes, and also provide new roofs for many property developers and homeowners who prefer this old roofing style. Thatched roofs are durable, sustainable and add real character to the aesthetics of a home. A thatched roof is more expensive to build than standard concrete tiles, but when laid correctly and properly maintained, thatched roofs can last up to 60 years. For your peace of mind, it’s vital to make sure that you’ve got the right insurance to protect your home. At the present time there are few brokers in the UK that can match our knowledge and understanding of what thatched property owners need.

No comments:

Post a Comment